Thinking about investing in mobile homes in 2025? Explore the advantages, potential risks, and key market trends to determine if this affordable real estate option is the right investment for you.

As housing costs continue to rise, mobile home investments are becoming an increasingly attractive option for investors looking for affordable real estate opportunities. While mobile homes have long been associated with low-cost living, they are now gaining recognition as viable investment assets. However, like any real estate venture, investing in mobile homes comes with its own set of advantages and challenges.

This guide will explore the potential benefits, risks, and key considerations for investors in 2025.

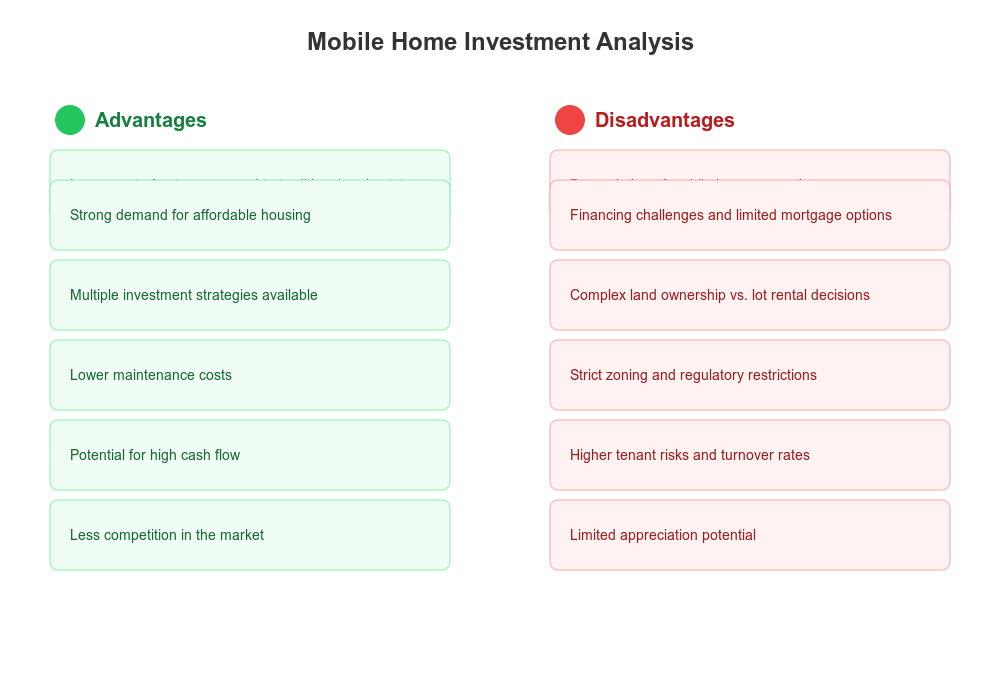

Pros of Investing in Mobile Homes

Lower Cost of Entry

One of the most significant advantages of mobile home investments is the relatively low purchase price. Compared to traditional single-family homes or multifamily properties, mobile homes require far less capital, making them an accessible option for investors with limited funds. In many cases, a mobile home can be purchased for a fraction of the cost of a conventional home, providing investors with a low-risk entry into real estate.

Strong Demand for Affordable Housing

The rising cost of housing has created a growing demand for affordable alternatives, and mobile homes fill this gap. Many people, including retirees, low-income families, and individuals looking for budget-friendly housing, are turning to mobile homes as a cost-effective solution. This consistent demand can provide investors with stable rental income and reduced vacancy rates.

Multiple Investment Strategies

Investors in mobile homes have several options for generating income, including:

-

Renting out individual mobile homes: A straightforward rental strategy that provides monthly cash flow.

-

Purchasing mobile home parks: Owning the land and leasing lots to mobile homeowners can be a profitable, low-maintenance strategy.

-

Flipping mobile homes: Buying, renovating, and reselling mobile homes for a profit can be a viable strategy in certain markets.

-

Rent-to-own arrangements: Allowing tenants to work toward homeownership can provide long-term income stability for investors.

Lower Maintenance Costs

Mobile homes generally have lower maintenance costs compared to traditional single-family or multifamily properties. If an investor owns a mobile home park rather than individual units, tenants are usually responsible for maintaining their homes, further reducing the owner's expenses. Additionally, mobile homes tend to have simpler structures, making repairs more affordable.

Simpler Construction Means Fewer Expensive Repairs

Unlike traditional homes, which often have complex architectural designs, large square footage, and multiple systems requiring upkeep, mobile homes are designed for efficiency. Many mobile homes have:

-

Fewer structural elements that require maintenance

-

Standardized materials that are easy to replace

-

Simple roofing and plumbing systems, which reduce repair costs

For example, replacing a roof on a traditional single-family home can cost anywhere from $7,000 to $15,000, whereas a mobile home roof replacement typically ranges from $1,000 to $5,000 depending on the materials used.

Tenant Responsibility for Maintenance in Mobile Home Parks

Investors who own mobile home parks benefit significantly from lower maintenance responsibilities. When a tenant owns their mobile home but rents the lot, they are responsible for maintaining the structure, plumbing, HVAC, and interior repairs. The park owner is typically only responsible for:

-

Maintaining common areas (e.g., roads, lighting, landscaping)

-

Utility infrastructure (if not directly managed by the city)

-

Managing lot spaces and ensuring compliance with park regulations

This shift in responsibility to tenants dramatically reduces an investor’s repair and maintenance expenses compared to owning a single-family rental or apartment complex, where landlords must cover virtually all maintenance costs.

Learn more- Your Essential Guide to Mobile Home Park Rules and Regulations

Lower Property Taxes and Insurance Costs

Since mobile homes are often classified as personal property rather than real estate, property taxes tend to be significantly lower than traditional homes. Additionally, insurance costs for mobile homes are generally more affordable, reducing the overall expense burden for investors.

Easier Utility Management

If an investor owns an entire mobile home park, they can choose to have tenants pay their own water, electricity, and gas bills, either directly through utility providers or through sub-metering systems. This setup further reduces overhead costs for the investor compared to managing utilities in traditional rental properties, where landlords often cover some or all utility expenses.

Key Strategies to Keep Maintenance Costs Low

-

Encourage tenant ownership: Mobile home park investors can reduce expenses by leasing lots rather than mobile homes. If tenants own their units, they take on the responsibility of upkeep and repairs.

-

Choose durable materials: When investing in mobile homes, selecting high-quality but cost-effective materials (such as vinyl plank flooring and metal roofing) can help reduce long-term maintenance expenses.

-

Conduct regular inspections: Preventative maintenance can help investors avoid costly repairs. Simple steps like checking plumbing, HVAC systems, and roofs periodically can prevent bigger issues.

-

Screen tenants carefully: Responsible tenants are more likely to take care of their homes, reducing maintenance and repair requests.

-

Invest in newer mobile homes: While older mobile homes may be cheaper upfront, they often come with higher maintenance costs. Investing in newer models with updated electrical, plumbing, and insulation can save money in the long run.

Potential for High Cash Flow

The affordability of mobile homes allows investors to acquire multiple units for the cost of a single traditional home. Since demand is strong and rental rates remain steady, mobile home investments can generate strong cash flow, particularly when operating a mobile home park where lot rents contribute to a steady income stream.

Higher Rent-to-Price Ratio

Mobile homes often provide a higher rent-to-price ratio compared to traditional real estate. For example, a mobile home purchased for $50,000 may generate $800 to $1,200 in monthly rent, while a $250,000 home might only bring in $1,500 to $2,000 in rent. This means investors can recover their investment much faster and enjoy a better return on investment (ROI).

Mobile Home Parks Provide Consistent Lot Rent

Owning a mobile home park is one of the most profitable ways to invest in mobile homes. Instead of renting out individual homes, park owners lease the land to mobile homeowners, who own the homes but pay lot rent (typically between $300 and $800 per month per lot). This model has several advantages:

-

Lower maintenance costs since tenants are responsible for their own homes

-

Long-term tenants, as moving a mobile home is costly and inconvenient

-

Minimal vacancies in well-maintained parks with strong demand

For example, a mobile home park with 50 lots charging $500 per month in lot rent generates $25,000 per month ($300,000 per year) in gross income. With low overhead costs, the net cash flow remains highly attractive.

Learn more- How to Find the Ideal Land for Your Mobile Home: Tips for Success

Section 8 and Government Assistance Programs

Many mobile home tenants qualify for housing assistance programs such as Section 8, which ensures a steady rental income for landlords. Government-backed rental payments reduce the risk of non-payment and provide financial security for investors.

Less Competition in the Market

Compared to single-family and multifamily real estate, mobile home investments are often overlooked by mainstream investors. This lower competition means there may be more opportunities to acquire properties at favorable prices.

Cons of Investing in Mobile Homes

Depreciation of Mobile Homes

Unlike traditional real estate, which often appreciates over time, mobile homes tend to depreciate in value, similar to vehicles. This makes them a less favorable option for long-term appreciation. However, if the mobile home is located in a well-maintained park or an area with rising property values, it may still hold its value or appreciate over time.

Financing Challenges

Financing a mobile home investment can be more difficult than securing a mortgage for a traditional home. Many banks consider mobile homes as personal property rather than real estate, making them ineligible for conventional mortgages. Investors may need to rely on cash purchases, seller financing, or specialized mobile home loans, which often come with higher interest rates.

Land Ownership vs. Renting a Lot

Investors purchasing individual mobile homes must decide whether to buy the land beneath them or rent a lot in a mobile home park. Owning the land can provide more control and long-term value, but it requires a larger investment. Renting a lot means paying monthly fees, which can cut into profits. Mobile home park investments, while potentially lucrative, require significant upfront capital and management expertise.

Zoning and Regulatory Restrictions

Many municipalities have strict zoning laws and regulations regarding mobile homes. Some areas have limited spaces available for mobile home parks, while others have restrictions on where mobile homes can be placed. Investors must carefully research local regulations to ensure compliance and avoid costly legal issues.

Tenant Risks and Turnover

Mobile home tenants often belong to lower-income brackets, which can increase the risk of late or missed rent payments. While many tenants remain in mobile homes long-term, financial instability may lead to higher eviction rates. Ensuring thorough tenant screening and maintaining a well-managed property can help mitigate these risks.

Limited Appreciation Potential

Unlike traditional real estate, mobile homes are typically not seen as long-term appreciating assets. However, if an investor owns the land, they may see value appreciation in the property itself. Additionally, improvements to mobile home parks—such as better infrastructure and amenities—can enhance value and attract higher-paying tenants.

Key Considerations for Mobile Home Investors in 2025

1. Location Matters

The profitability of a mobile home investment heavily depends on its location. Areas with strong job markets, population growth, and limited affordable housing options are ideal for mobile home investments.

2. Market Research is Essential

Before investing, it is crucial to analyze the demand for mobile homes in a particular region. Research vacancy rates, rent trends, and local regulations to ensure a strong return on investment.

3. Consider Mobile Home Parks for Long-Term Gains

While individual mobile home rentals can provide cash flow, owning a mobile home park can be more lucrative. By leasing out land lots rather than homes, investors can generate consistent income without the responsibility of maintaining individual units.

4. Understand Legal and Tax Implications

Mobile home investments come with unique legal and tax considerations. Investors should consult with real estate attorneys and tax professionals to ensure compliance with local laws and optimize their tax benefits.

5. Plan for Financing Challenges

Since traditional mortgage options are limited, investors should explore alternative financing solutions, such as seller financing, private lenders, or partnerships with mobile home park owners.

Final Thoughts

Investing in mobile homes can be a smart financial move for those looking for affordable entry points into real estate with strong cash flow potential. The high demand for affordable housing, coupled with lower purchase and maintenance costs, makes mobile homes an attractive option for both beginner and experienced investors.

However, challenges such as depreciation, financing difficulties, and regulatory restrictions must be carefully considered. Investors who focus on purchasing land (such as mobile home parks) or strategically buying in high-demand areas may see the most success.

For those willing to do their due diligence, mobile home investments can offer a unique opportunity in 2025, providing consistent returns and financial stability in an evolving real estate market.