Mobile home insurance is more than just protection—it's your key to a secure and worry-free lifestyle. In this guide, we'll explore how the right coverage can safeguard your home while offering smart ways to save. Let's dive in.

Owning a mobile home offers an affordable and flexible lifestyle, but like any type of home, it comes with its own set of risks. Securing the best mobile home insurance is crucial for protecting your home, belongings, and financial well-being. This comprehensive guide will help you understand what mobile home insurance covers, what factors affect your premiums, and how you can find the right policy that balances protection with smart savings.

What Is Mobile Home Insurance?

Mobile home insurance, also known as manufactured home insurance, is a specialized type of coverage designed to protect mobile or manufactured homes against common risks such as fire, theft, vandalism, and severe weather. It works similarly to standard homeowners insurance but is tailored to the unique structure and risks of mobile homes. Having the best mobile home insurance ensures peace of mind, knowing that your investment is protected from potential financial losses.

Just like traditional homeowners insurance, mobile home insurance provides coverage for the home itself, personal belongings, liability protection, and more. The best mobile home insurance policies also offer additional coverage options, such as protection for other structures or loss of use in case you are temporarily unable to live in your home due to damage.

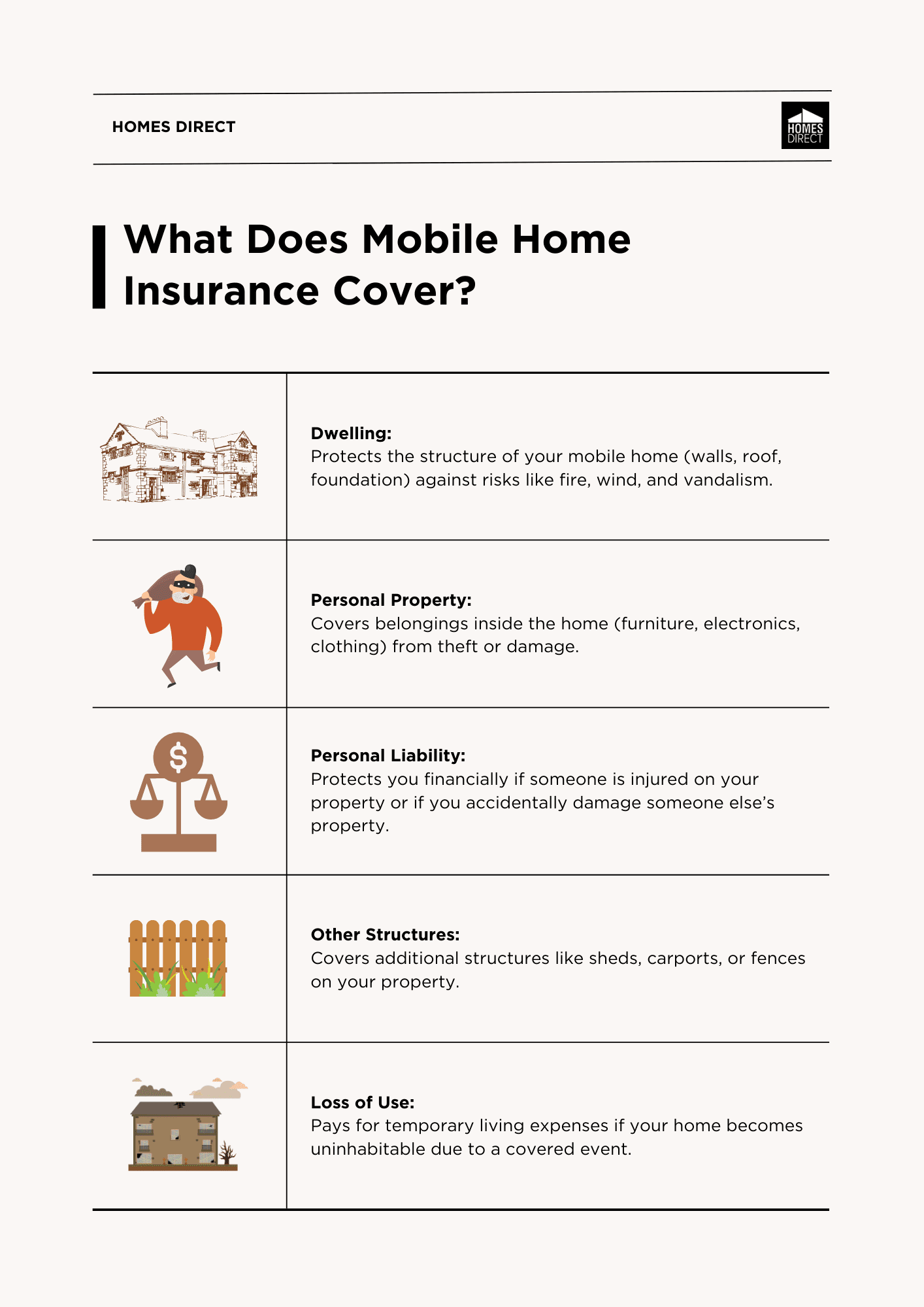

What Does Mobile Home Insurance Cover?

Mobile home insurance typically covers several key areas, each designed to protect different aspects of your home and property.

Let’s break down the main coverage components:

1. Dwelling

Dwelling coverage is the core component of any mobile home insurance policy. It protects the physical structure of your mobile home, including the walls, roof, foundation, and built-in appliances, against risks like fire, windstorms, hail, and vandalism. This coverage helps cover the cost of repairs or rebuilding if your home is damaged by a covered peril. If you're looking for the best mobile home insurance, it’s essential to ensure that the dwelling coverage provides enough protection to rebuild your home in case of total loss.

For example, if a fire damages part of your home, the dwelling coverage will help pay for repairs to restore your home to its pre-loss condition. Be sure to choose coverage limits that reflect the full replacement cost of your mobile home.

2. Personal Property

Personal property coverage protects your belongings inside the mobile home, such as furniture, electronics, clothing, and other household items. If your possessions are stolen, damaged, or destroyed by a covered event, this coverage helps repair or replace them.

For instance, if your home is burglarized and electronics or furniture are stolen, personal property coverage would cover the cost of replacing those items, up to the policy’s limits. When selecting the best mobile home insurance, it's crucial to accurately assess the value of your belongings to ensure your policy provides adequate coverage.

3. Personal Liability

Personal liability coverage protects you financially if someone is injured on your property or if you accidentally cause damage to someone else’s property. For example, if a guest slips and falls on your property and requires medical attention, personal liability coverage helps cover legal fees, medical bills, and any settlement costs that may arise.

This coverage also applies if you or a family member accidentally cause damage to a neighbor's property. Personal liability is an important part of mobile home insurance because it shields you from potentially costly lawsuits or claims against you.

4. Other Structures

Other structures coverage includes protection for additional structures on your property that are separate from the main dwelling, such as sheds, carports, fences, or detached garages. If these structures are damaged by a covered peril (e.g., a storm or vandalism), the best mobile home insurance will help cover the cost of repairs or rebuilding.

For instance, if a windstorm damages your carport or knocks down a fence, other structures coverage would help pay for the necessary repairs, ensuring these auxiliary structures are fully restored.

5. Loss of Use

Loss of use coverage is vital if your mobile home becomes uninhabitable due to a covered event, such as fire or significant storm damage. This coverage helps pay for temporary living expenses, such as hotel stays, meals, and other related costs, while your home is being repaired or rebuilt.

For example, if a fire severely damages your mobile home and you need to stay in a hotel for several weeks, loss of use coverage would cover those costs, allowing you to maintain your standard of living while your home is restored.

What Affects Mobile Home Insurance Rates?

Several factors influence how much you'll pay for mobile home insurance. Understanding these variables will help you make informed decisions when shopping for the best mobile home insurance and ensure you get the coverage you need at an affordable price.

Coverage Limits

One of the primary factors affecting the cost of insurance for a mobile home is the amount of coverage you choose. Higher coverage limits provide more financial protection and increase the policy's overall cost. It’s essential to balance the coverage limits with the value of your home and belongings to avoid underinsurance or overpaying for unnecessary protection.

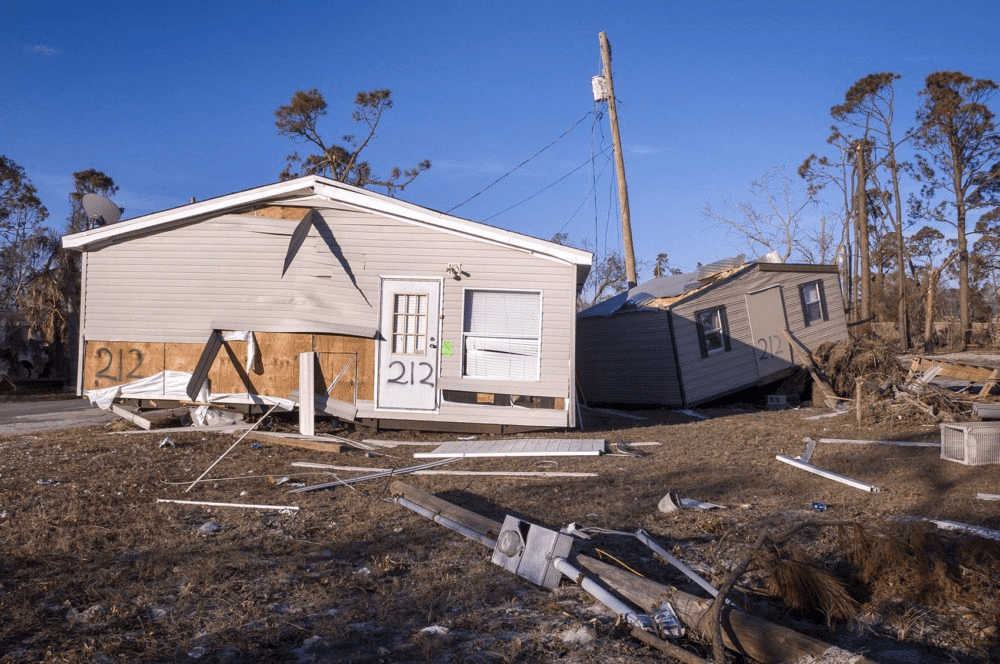

Location

Where your mobile home is located plays a significant role in determining insurance premiums. Insurers assess the risk associated with your home's geographic location based on factors like:

-

Natural Disasters: Areas prone to hurricanes, tornadoes, floods, or wildfires generally have higher insurance rates because the risk of damage is greater.

-

Crime Rates: Homes in areas with higher crime rates, especially theft or vandalism, may have higher premiums.

-

Proximity to Fire Departments: Living closer to a fire department or fire hydrant can reduce your rates because it increases the likelihood of a quick response in case of a fire.

If your mobile home is located in a high-risk area, you may need to add additional coverage for specific risks like floods or hurricanes, which will affect the overall cost of your insurance for mobile home.

Deductible Size

Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premium, but it also means you’ll need to cover more of the initial costs in the event of a claim. The best mobile home insurance offers flexible deductible options, allowing you to customize your policy based on your financial comfort level.

Higher Deductible: Lowers your monthly premium but increases your out-of-pocket expenses during a claim.

Lower Deductible: Raises your premium but reduces your upfront cost if you need to make a claim.

Age and Condition of Home

The age and condition of your mobile home significantly affect how much you’ll pay for insurance. Newer homes generally have updated safety features and are built to withstand weather-related events better than older homes, which can result in lower premiums.

Homes built before modern safety regulations or that haven't been updated may pose a greater risk, leading to higher insurance premiums. If your home is older, it’s essential to ensure it meets safety standards to avoid higher rates.

Discounts

Most insurance companies offer discounts that can help reduce the cost of your mobile home insurance. Common discounts include:

-

Bundling Policies: If you bundle your mobile home insurance with other types of insurance (e.g., auto or life insurance) from the same company, you may qualify for a discount.

-

Safety Features: Homes equipped with safety features like smoke detectors, security systems, storm shutters, and fire alarms may qualify for lower premiums because they reduce the risk of damage or loss.

-

Claims-Free Discount: If you haven’t filed any insurance claims for a certain period, you may be eligible for a discount.

-

Loyalty Discounts: Long-term customers may receive loyalty discounts from their insurance provider, lowering the overall cost of their policy.

How Much Is Mobile Home Insurance?

The cost of mobile home insurance can vary widely depending on the factors mentioned above, including location, coverage limits, and the age of the home. On average, insurance for a mobile home costs between $300 and $1,000 per year, though homes in high-risk areas may see higher premiums.

To determine how much is mobile home insurance for your specific situation, it’s essential to request quotes from multiple insurance providers. Be sure to compare not only the premiums but also the coverage levels, deductibles, and available discounts to ensure you're getting the best value for your money. Additionally, working with an experienced insurance agent can help you find the best mobile home insurance tailored to your needs and budget.

Average Mobile Home Insurance Costs

While there’s no one-size-fits-all answer to how much is mobile home insurance, here’s a general breakdown of costs:

-

Basic Coverage: If you live in a low-risk area and opt for basic coverage, you can expect to pay around $300 to $500 per year.

-

Moderate Coverage: For homes in moderately risky areas, with more comprehensive coverage, premiums typically fall between $500 and $700 per year.

-

High Coverage in High-Risk Areas: Homes in high-risk areas with comprehensive coverage may see premiums exceeding $1,000 per year.

What Doesn’t Mobile Home Insurance Cover?

While mobile home insurance provides essential protection, there are certain situations and damages it typically doesn’t cover. Knowing these exclusions can help you understand where additional coverage might be necessary.

Here are some common exclusions from best mobile home insurance policies:

1. Flood Damage

Standard mobile home insurance does not cover damage caused by floods. If your home is in a flood-prone area, you’ll need to purchase separate flood insurance through the National Flood Insurance Program (NFIP) or a private insurer.

2. Earthquake Damage

Most policies exclude damage caused by earthquakes or earth movement. If you live in an earthquake-prone area, you'll need to buy separate earthquake insurance.

3. Wear and Tear

Mobile home insurance does not cover routine maintenance or damage from normal wear and tear. For example, damage due to aging, rust, mold, or deterioration over time is excluded.

4. Pest Infestations

Damage caused by termites, rodents, or other pests is not covered under standard mobile home insurance policies. Preventive maintenance is necessary to avoid these issues.

5. Intentional Damage

If damage is caused intentionally by the homeowner or residents of the home, it is not covered by mobile home insurance. Fraudulent claims are also excluded.

6. Mechanical Breakdown

Damage to appliances or systems due to mechanical or electrical failure is typically not covered. You may need a separate home warranty or service contract for coverage of these items.

7. Government Seizure

Mobile home insurance does not cover any loss or damage due to government action, such as the confiscation or destruction of property.

Wrapping It Up

Securing the best mobile home insurance is essential for protecting your home, personal property, and financial future. From dwelling coverage to personal liability and loss of use, mobile home insurance offers comprehensive protection against life’s unexpected events. While rates vary based on factors like location, coverage limits, and the age of your home, understanding these variables can help you make an informed decision.

To find the best mobile home insurance for your needs, take the time to compare policies, explore discounts, and consult with insurance experts. By doing so, you’ll not only secure peace of mind but also ensure that your home and belongings are well-protected for years to come.