Difficult to understand all the terms of Real Estate transactions? Let’s go over the NOI (Net Operating Income), discuss its value in the process, and understand how and when it matters. Let’s dive in!

What Is Net Operating Income (NOI)

Net Operating Income (NOI) is a financial metric used in real estate investing and property management. It represents the income generated by a property after deducting all operating expenses but before accounting for taxes and financing costs. It serves as a measure of the property's profitability and helps investors evaluate the potential return on investment.

What Is NOI In Real Estate?

In real estate, Net Operating Income (NOI) is a critical financial metric used to evaluate the profitability and performance of income-generating properties. NOI provides a clearer picture of a property's operational efficiency by focusing on the revenue generated from its operations, independent of external factors like taxes and financing.

NOI is particularly relevant for commercial real estate properties such as office buildings, retail centers, industrial complexes, and apartment buildings. It helps investors, property owners, and lenders assess the property's income potential, make informed investment decisions, and compare different properties.

To understand NOI in real estate, let's dive into a more detailed explanation:

The importance of NOI

NOI is a key indicator of a property's financial health and viability. It reflects the property's ability to generate income from its operations, which is essential for investors seeking cash flow and return on investment. By focusing on the property's operational income, NOI allows for a more accurate assessment of the property's financial performance and helps investors make informed decisions.

Components of NOI

Net Operating Income is calculated by subtracting the property's operating expenses from its total operating income. Let's examine the key components of NOI:

a. Total Operating Income: This includes all income generated by the property's operations. It typically comprises rental income from tenants, parking fees, revenue from ancillary services like laundry facilities or vending machines, and any other income directly related to the property.

b. Operating Expenses: These are the costs associated with operating and maintaining the property. Common operating expenses include property taxes, property insurance, property management fees, utilities, maintenance and repairs, landscaping, janitorial services, security, and administrative expenses.

Image by storyset on Freepik

NOI Calculation

The formula to calculate NOI is straightforward:

NOI = Total Operating Income - Operating Expenses

By subtracting the property's operating expenses from its total operating income, you arrive at the Net Operating Income figure.

Significance of NOI in Real Estate Investing

NOI is a fundamental measure used in real estate investing for several reasons:

a. Property Valuation: NOI is a key factor in determining the value of income-producing properties. The value of such properties is often calculated based on their expected income stream. By dividing the NOI by an appropriate capitalization rate (Cap Rate), investors can estimate the property's value.

b. Investment Analysis: NOI allows investors to analyze and compare different investment opportunities. By considering the property's operating income and expenses, investors can evaluate the potential return on investment and assess the viability of various real estate ventures.

c. Financing Considerations: Lenders also use NOI as an important factor when assessing the creditworthiness of a property. Since NOI reflects the property's income-generating capacity, lenders can gauge whether the property can generate sufficient income to cover its operating expenses and debt service obligations.

d. Performance Evaluation: NOI provides a metric for evaluating a property's financial performance over time. By monitoring changes in NOI, property owners, and investors can assess whether the property is improving in terms of income generation and operational efficiency.

Image by xb100 on Freepik

Limitations of NOI

While NOI is a valuable metric, it's important to be aware of its limitations:

a. External Factors: NOI does not consider factors external to the property, such as market conditions or economic fluctuations. It focuses solely on the property's operational income and expenses. Thus, changes in market rents, vacancy rates, or other market dynamics can impact the property's overall financial performance.

b. Financing and Taxes: NOI does not account for financing costs or income taxes. Different financing structures, interest rates, and tax implications can significantly affect a property's profitability. Therefore, investors should consider these aspects separately when evaluating the overall financial viability of a property.

c. Accuracy of Data: The accuracy of NOI calculations relies on the accuracy and consistency of the data used. Errors or omissions in reporting operating income or expenses can lead to an inaccurate NOI figure. Therefore, it's essential to ensure accurate and reliable financial data when calculating and using NOI.

How To Calculate Net Operating Income

Let's consider an example to illustrate the calculation of NOI. Suppose a commercial property generates $300,000 in rental income per year. The property incurs $50,000 in operating expenses, including property taxes, insurance, maintenance, utilities, and property management fees.

To calculate the NOI:

|

NOI = Total Operating Income - Operating Expenses = $300,000 - $50,000 = $250,000

In this example, the Net Operating Income (NOI) for the commercial property is $250,000. |

Gross Operating Income vs. Net Operating Income

Gross Operating Income (GOI) is the total income generated by a property before deducting any expenses. It includes all revenue streams from the property, such as rental income and other operating income.

Net Operating Income (NOI), on the other hand, deducts all operating expenses from GOI to reflect the property's profitability. GOI is a broader measure, while NOI provides a more accurate representation of the property's operational performance.

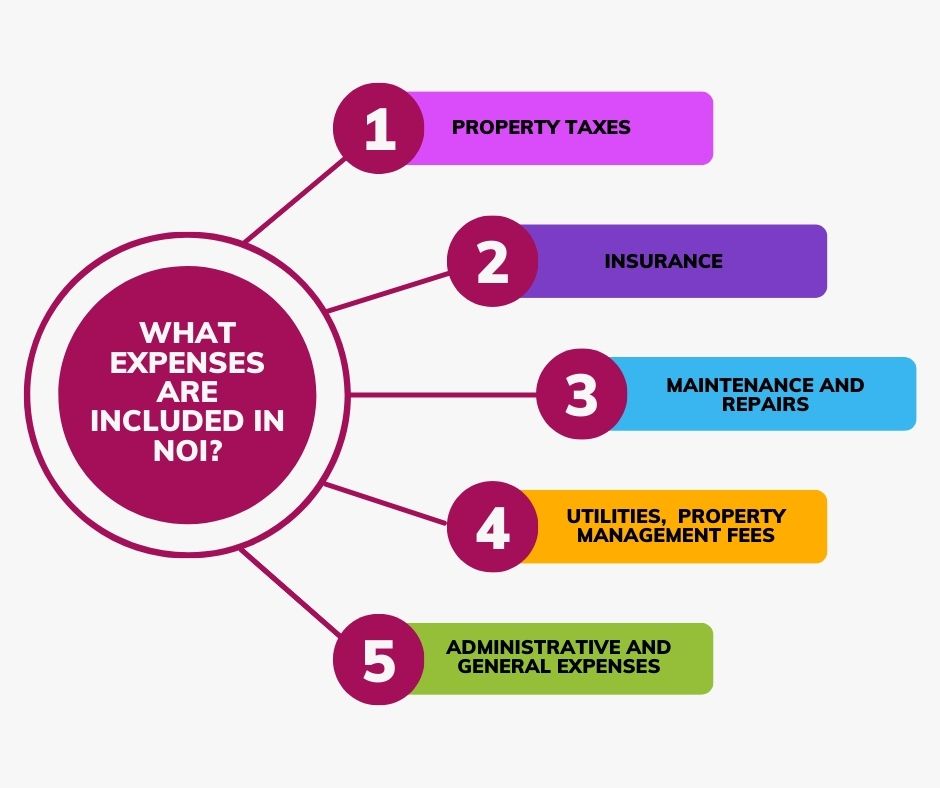

What Expenses Are Included In NOI?

Net Operating Income includes various operating expenses related to the property's day-to-day operations. These expenses typically include:

a. Property Taxes: The amount paid in property taxes to local authorities.

b. Insurance: Premiums paid for property insurance coverage.

c. Maintenance and Repairs: Costs associated with maintaining and repairing the property.

d. Utilities: Expenses for utilities like electricity, water, heating, and cooling.

e. Property Management Fees: Fees paid to property management companies for their services.

f. Administrative and General Expenses: Other miscellaneous expenses related to property operations, such as office supplies and marketing costs.

These expenses are subtracted from the property's total operating income to arrive at the Net Operating Income.

What Isn’t Included In Net Operating Income?

Net Operating Income does not include certain expenses and income sources, such as:

a. Financing Costs: Interest payments on loans, mortgage payments, and other financing-related expenses are not included in NOI.

b. Income from Capital Gains: Any income generated from the appreciation of the property's value over time, such as capital gains upon selling the property, is not part of NOI.

c. Income Taxes: NOI does not consider income taxes paid by the property owner.

How NOI Is Used To Determine Cap Rate

Net Operating Income is used to determine the Capitalization Rate (Cap Rate), which is a key metric for real estate investors. The Cap Rate is calculated by dividing the property's NOI by its current market value or purchase price.

The formula is as follows:

Cap Rate = NOI / Property Value

The Cap Rate represents the expected return on investment for a property. It helps investors assess the property's income-generating potential and compare it with other investment opportunities.

Image by mamewmy on Freepik

How To Improve NOI

There are several strategies to improve Net Operating Income:

a. Increase Rental Income: Implementing rent increases or optimizing occupancy rates to generate higher rental income.

b. Reduce Operating Expenses: Identifying cost-saving opportunities, negotiating lower vendor contracts, and implementing energy-efficient solutions to decrease operating expenses.

c. Improve Property Management: Efficient property management practices can reduce vacancies, minimize turnover costs, and improve overall operational efficiency.

d. Add Revenue Streams: Exploring additional income sources such as adding amenities, leasing out unused spaces, or providing value-added services to increase total operating income.

e. Renovations and Upgrades: Making strategic property improvements that enhance the property's attractiveness and potentially allow for higher rental rates.

f. Expense Auditing: Regularly review operating expenses to identify potential cost-saving opportunities and eliminate unnecessary expenditures.

Pros & Cons Of Using NOI For Investment Properties

Pros:

-

Provides a standardized metric for comparing the financial performance of different investment properties.

-

Helps investors assess the property's profitability and potential return on investment.

-

Allows for easy comparison of properties regardless of financing structures or tax implications.

-

Enables investors to evaluate the property's income-generating potential independently of external factors.

Cons:

-

Does not consider individual financing arrangements or tax implications, which may vary for each investor.

-

Does not account for market fluctuations or potential future income growth.

-

Relies on accurate and consistent reporting of income and expenses.

In conclusion, Net Operating Income (NOI) is a crucial metric in real estate that provides insight into the financial performance and profitability of income-generating properties. By focusing on operational income and expenses, NOI allows investors, property owners, and lenders to assess the property's income potential, make informed investment decisions, and evaluate its value.

While NOI has its limitations, it remains a fundamental tool for analyzing and comparing real estate investment opportunities.

FAQ

What is a good NOI for a rental property?

Although it might vary based on location, property type, and market conditions, a reasonable net operating income (NOI) for a rental property is often thought to be around 70% of the property's gross income.

What is not included in net operating income?

Taxes, capital expenditures, one-time charges like property purchase costs, and financing costs like mortgage or interest payments are not included in net operating income (NOI).

What are the assumptions of the net operating income approach?

The net operating income approach makes the following assumptions: stable rental income, constant running costs, no substantial changes in property value, precise market rent projections, and fair estimations for vacancy and collection loss.

What are the limitations of net operating income?

The limits of net operating income (NOI) include not accounting for financing and tax factors, taking property value changes over time into consideration, capturing potential future income growth or fall, and not representing specific investor circumstances or goals.

What decreases net operating income?

Increased operational costs (such as property management fees and maintenance costs), higher vacancy rates, lower rental income, higher property taxes or insurance premiums, and unforeseen repairs or capital expenditures can all diminish net operating income (NOI).