What is Remote Closing?

In today's fast-paced digital world, the concept of remote work has become increasingly prevalent across various industries. Real estate, in particular, has witnessed a significant shift toward remote closing, where closers can finalize transactions without being physically present. This article explores the world of remote closing, from the role of remote closers to the process of becoming one, and provides insights into the benefits and challenges associated with this growing trend.

Remote closing refers to the practice of finalizing real estate transactions without the need for all parties involved to be physically present. Through the utilization of digital tools and technology, closers can facilitate the signing of documents, handle financial transactions, and complete the necessary legal formalities remotely.

What’s a Remote Closer?

A remote closer is an essential role in the remote closing process. A remote closer is a licensed professional who oversees and facilitates the completion of a real estate transaction remotely. They act as a liaison between the buyer, seller, and other parties, ensuring that all necessary documents are properly executed and legally binding.

The responsibilities of a remote closer include reviewing and preparing the closing documents, coordinating with the involved parties to schedule the remote closing, verifying the identity of the participants, and guiding them through the necessary steps to finalize the transaction. They also play a crucial role in ensuring compliance with state and federal laws governing remote closings.

Remote Closing of a House

Remote House Closing The process of remote house closing begins with the selection of a specialized remote closing agent who facilitates transactions from a distance. This agent acts as a liaison among the buyer, seller, and other involved parties, guiding them through the necessary steps and ensuring accurate completion and signing of all required documentation.

To initiate a remote closing, secure online platforms are typically utilized, enabling document sharing and electronic signatures. These platforms provide a safe environment for exchanging confidential information and maintaining transaction integrity. Additionally, video conferencing tools enable real-time communication and identity verification.

Remote Closing Job Description

A remote closing job description typically outlines the responsibilities and qualifications required for a remote closer position. While specific job descriptions may vary depending on the employer and jurisdiction, here are some common elements you may find in a remote closing job description:

-

Facilitate remote closings by coordinating with all parties involved in a real estate transaction.

-

Review and prepare closing documents, ensuring accuracy and compliance with relevant regulations.

-

Verify the identity of participants and guide them through the remote closing process.

-

Communicate with buyers, sellers, lenders, and other professionals to ensure a smooth closing experience.

-

Utilize technology and software platforms to facilitate electronic signatures and document sharing.

-

Stay updated on state and federal laws governing remote closings and ensure compliance.

-

Maintain confidentiality and security of sensitive client information during the remote closing process.

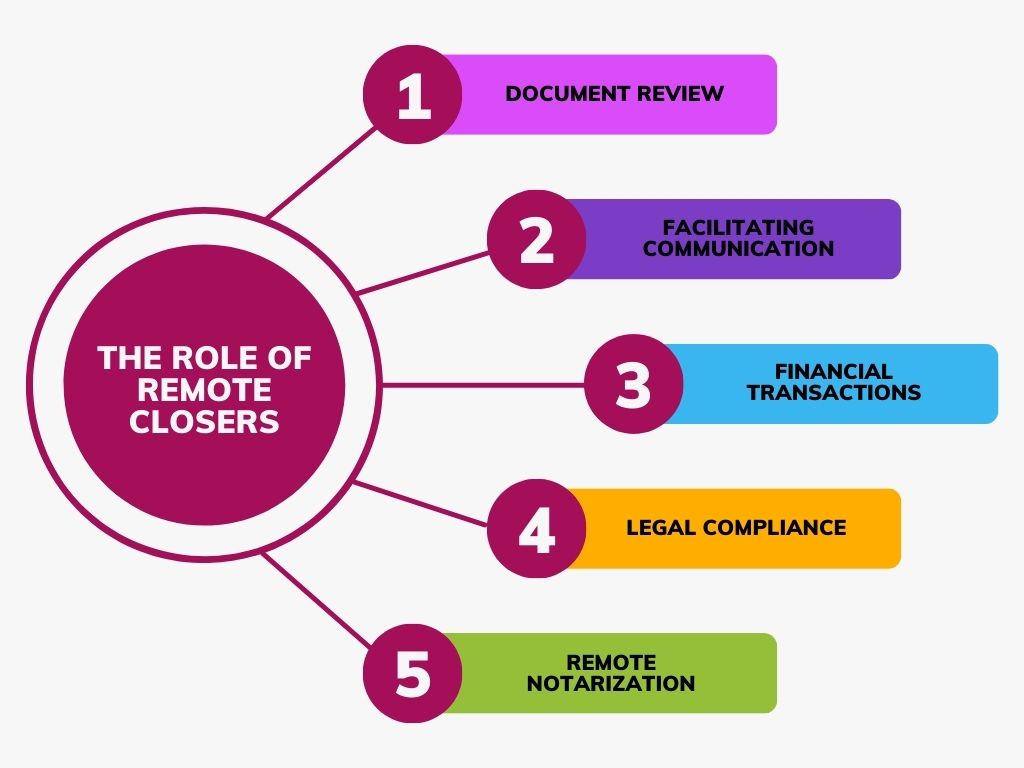

The Role of Remote Closers

Remote closers play a vital role in ensuring the smooth and efficient execution of real estate transactions. Their responsibilities include:

-

Document Review: Remote closers meticulously review all legal documents and contracts related to the transaction, ensuring their accuracy and compliance with relevant regulations.

-

Facilitating Communication: They serve as a bridge between buyers, sellers, real estate agents, and other stakeholders, facilitating effective communication throughout the closing process.

-

Financial Transactions: Remote closers handle the transfer of funds, ensuring that payments are made securely and promptly.

-

Legal Compliance: They ensure that all legal formalities, such as obtaining necessary signatures and notarizations, are completed accurately and in accordance with applicable laws and regulations.

-

Remote Notarization: One of the essential aspects of remote closing is remote online notarization (RON). A remote closer coordinates with a qualified online notary who digitally verifies the identities of the participants and witnesses the signing of documents via video conferencing tools.

-

Fund Disbursement: The remote closer ensures that the funds are properly disbursed to the appropriate parties involved in the transaction. They coordinate with lenders and title companies to ensure a secure and timely transfer of funds.

How to Become a Remote Closer in 5 Steps

If you're interested in pursuing a career as a remote closer, here are five steps to get you started:

a) Step 1: Acquire the Required Education and Training Obtain a high school diploma or equivalent qualification and consider pursuing a degree in real estate, finance, or a related field. Completing training programs specific to remote closing and gaining relevant certifications can also enhance your credibility.

b) Step 2: Gain Industry Experience Build a strong foundation by working in the real estate industry. Consider starting as a real estate agent or working in a related position to gain valuable experience and insights into the closing process.

c) Step 3: Develop Strong Communication Skills Effective communication is key in remote closing. Hone your interpersonal skills, as well as your ability to convey complex information clearly and concisely. This will help you build trust and maintain professional relationships with clients.

d) Step 4: Stay Updated with Technology Familiarize yourself with the latest digital tools and software used in remote closing. This includes e-signature platforms, virtual meeting software, and document management systems. Staying technologically proficient will enhance your efficiency and effectiveness as a remote closer.

e) Step 5: Network and Build Relationships Networking plays a crucial role in the real estate industry. Attend industry events, join professional associations, and engage with peers and experts in the field. Building a strong professional network can lead to valuable opportunities and referrals.

Tools Needed for Remote Closing

To facilitate a successful remote closing, certain tools and technologies are essential. These include:

-

Video Conferencing Software: Platforms like Zoom, Microsoft Teams, or Google Meet enable participants to have virtual meetings, witness document signings, and address any concerns or queries in real time.

-

Electronic Signature Platforms: Services like DocuSign or Adobe Sign allow participants to digitally sign documents securely. These platforms also provide audit trails and authentication measures to ensure the integrity of the signatures.

-

Document Sharing and Storage: Cloud-based file-sharing services such as Dropbox or Google Drive enable secure sharing, storage, and access to documents throughout the closing process. These platforms ensure that all parties have the necessary information readily available.

How Much Do Remote Closers Make?

Remote closers play a crucial role in facilitating smooth and efficient real estate transactions. As with any profession, the earnings of remote closers can vary depending on factors such as experience, location, and the number of transactions handled. While there is no fixed salary for remote closers, they typically earn a fee or commission for their services, which is typically a percentage of the transaction amount.

According to industry reports, remote closers can earn an average annual income ranging from $40,000 to $70,000. However, it's important to note that this figure can vary significantly based on individual circumstances and market conditions. Highly experienced and skilled remote closers may earn more, especially if they handle a high volume of transactions or work in areas with a high demand for remote closing services.

.jpeg)

NOI (Net Operating Income)

While remote closings bring convenience and efficiency to the home-buying process, it is essential to consider the financial implications. Net Operating Income (NOI) is a crucial metric that determines the profitability of a rental property. NOI is calculated by subtracting operating expenses from the property's gross income. When purchasing a property remotely, buyers must carefully assess the projected NOI to ensure a sound investment.

One advantage of remote closings is the ability to leverage technology to access property information and financial data remotely. Buyers can conduct due diligence, review property records, and evaluate financial statements without being physically present. This enables informed decision-making and helps potential investors assess the NOI accurately.

However, it is still crucial for buyers to consult with professionals such as real estate agents, property managers, and accountants to ensure a comprehensive evaluation of the property's financial viability. These experts can provide valuable insights into market trends, expenses, and potential rental income. By combining technology with expert advice, buyers can make informed decisions and mitigate risks associated with remote closings.

Remote Online Notarization (RON): Ensuring Security and Legitimacy

Central to the success of remote closing is Remote Online Notarization (RON). Notarization is a crucial component of the closing process, as it ensures the validity and authenticity of important documents. RON allows for the remote notarization of these documents, eliminating the need for physical presence in front of a notary public.

RON employs advanced technology, including audiovisual conferencing and identity verification tools, to facilitate secure remote notarization. The notary public interacts with the parties involved verifies their identities, witnesses the signing of documents, and applies their electronic signature and notary seal. This process provides a level of security and convenience comparable to traditional in-person notarization.

How to Start Remote Closing: A Step-by-Step Guide

If you're interested in engaging in a remote closing, follow these steps to initiate the process:

-

Find a reputable remote closer: Conduct thorough research to identify a qualified professional who specializes in remote closings. Look for experience, certifications, and positive reviews from previous clients.

-

Contact the remote closer: Reach out to the remote closer to discuss your specific needs and establish a rapport. They will guide you through the necessary documentation and requirements for the remote closing.

-

Gather and exchange documents: Prepare all the necessary documents required for the closing process. Utilize secure online platforms to share these documents with the remote closer and other involved parties.

-

Schedule the remote closing: Coordinate a suitable date and time for the virtual closing with all parties involved, including the remote closer, buyer, seller, and any other relevant individuals.

-

Conduct the remote closing: On the scheduled date, join the virtual meeting with the remote closer and other participants. Follow their instructions for document signing, notarization, and any additional requirements.

-

Finalize the transaction: Once all parties have completed the necessary steps and signed the required documents, the remote closer will ensure the proper filing and recording of the transaction, bringing the closing process to a successful conclusion.

Can You Close on a House Virtually? Advantages and Considerations

Closing on a house virtually offers several advantages for both buyers and sellers. Firstly, it eliminates the need for time-consuming travel, reducing logistical challenges and expenses. Additionally, remote closing provides greater flexibility, enabling parties to engage in the process from different locations. This aspect is particularly beneficial for those involved in long-distance transactions or individuals with limited mobility.

Despite the numerous benefits, it is important to consider a few factors before opting for remote closing. Adequate internet connectivity, access to secure online platforms, and a reliable computer or mobile device are essential requirements. Additionally, parties must ensure compliance with legal and regulatory frameworks specific to their jurisdiction to avoid any complications during the remote closing process.

The Benefits of Remote Closing

-

Convenience and Flexibility: Remote closing eliminates the need for all parties to be physically present, offering convenience and flexibility in scheduling transactions.

-

Time and Cost Savings: By eliminating the need for travel and reducing paperwork, remote closing streamlines the process, saving time and reducing costs for all involved parties.

-

Access to a Larger Market: Remote closing allows closers to work with clients from different geographic locations, expanding their reach and potential client base.

-

Environmental Impact: Reducing the need for physical travel and paper usage has a positive impact on the environment, making remote closing a more sustainable option.

FAQ

Do I need any special equipment for remote closing?

To participate in a remote closing, you typically need a computer or a mobile device with internet access. It's also recommended to have a webcam and a microphone for video conferences, as well as a printer to produce hard copies of important documents if needed.

How and where can I find a reputable remote closing platform or service provider?

To find a reputable remote closing platform or service provider, you can start by seeking recommendations from your real estate agent, attorney, or lender. Additionally, you can research online, read reviews, and compare the features, security measures, and pricing of different platforms. Ensure that the platform you choose complies with legal requirements and has a good track record in facilitating remote closings.

Can I Close on a House Remotely?

Yes, in many cases, it is possible to close on a house remotely. Remote closings have gained popularity, especially in situations where physical presence may be challenging or inconvenient. However, the availability of remote closing options may vary depending on local regulations and the preferences of the parties

Conclusions about NOI

In conclusion, remote closing has revolutionized the real estate industry by providing a convenient and efficient way to complete transactions. The role of a remote closer is crucial in ensuring a smooth closing process, and the use of tools like remote online notarization enhances overall efficiency and accessibility. Remote closers can earn a competitive income, and becoming one involves a combination of education, experience, communication skills, staying updated with industry trends, and building a professional network. With the continued advancement of technology, remote closing is expected to become even more prevalent in the future, transforming the way real estate transactions are conducted.