Looking to finance your mobile home? Explore different loan types and qualification tips, this guide will help you navigate the process and find the best financing option for your dream home.

Mobile homes offer a unique and affordable housing option for many people. Whether you are looking to buy a mobile home as a primary residence, a vacation spot, or an investment property, securing a mobile home loan is an essential step. This guide will provide a comprehensive overview of mobile home loans, including types, eligibility factors, loan terms, and application processes, to help you make an informed decision.

What is a Mobile Home Loan?

A mobile home loan is a type of financing specifically designed for the purchase or refinancing of manufactured or mobile homes. Unlike traditional home loans that are used for purchasing fixed real estate properties, mobile home loans can accommodate the unique nature of mobile homes, which may be situated on leased land, within mobile home parks, or on privately owned plots of land.

Mobile homes, also known as manufactured homes, are built in a factory setting and then transported to their final location. They offer an affordable and flexible housing solution for many individuals and families. However, the financing for these homes is distinct due to their construction process and placement options.

Mobile home loans cater to various scenarios and needs, including:

-

Homes in Mobile Home Parks: These loans are suitable for mobile homes placed on rented lots within a mobile home park. In such cases, the loan does not include the land, only the home itself.

-

Homes on Leased Land: Similar to homes in mobile home parks, these loans finance the home but not the land it sits on.

-

Homes on Owned Land: When a mobile home is placed on land owned by the borrower, the loan can cover both the home and the land, making it more akin to traditional real estate financing.

Key Characteristics of Mobile Home Loans

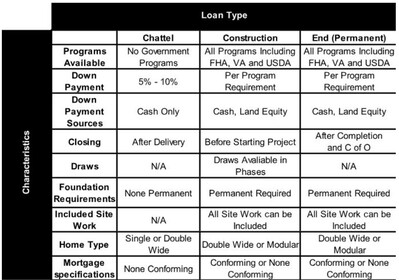

Loan Classification: Mobile home loans can be classified into two main categories:

-

Chattel Loans: These loans treat the mobile home as personal property rather than real estate. They are common for homes located on leased land or within mobile home parks. Chattel loans usually have shorter terms and higher interest rates compared to traditional mortgages.

-

Real Property Loans: When a mobile home is permanently affixed to a foundation and situated on owned land, it can qualify for real property loans. These loans are similar to traditional mortgages, offering longer terms and often lower interest rates.

-

Interest Rates and Terms: The interest rates and loan terms for mobile home loans can vary widely. Chattel loans often come with higher interest rates and shorter terms (typically 15-20 years) due to the perceived higher risk. In contrast, real property loans can offer more favorable terms similar to conventional home loans, with terms ranging from 15 to 30 years.

-

Down Payment Requirements: The down payment required for a mobile home loan can depend on the type of loan and the lender. Government-backed loans (such as FHA or VA loans) may have lower down payment requirements, while conventional loans might require a higher down payment.

-

Credit Score and Eligibility: Eligibility for mobile home loans is influenced by the borrower’s credit score, income, and employment stability. Government-backed loans generally have more lenient credit score requirements, whereas conventional loans may require higher credit scores.

-

Loan Amount: The amount that can be borrowed under a mobile home loan varies based on the type of loan, the value of the home, and whether the loan includes the land. Chattel loans typically have lower maximum loan amounts compared to real property loans.

Types of Mobile Home Loans

FHA Title I Loans

FHA Title I loans are intended for financing both new and existing mobile homes, whether they are located on rented lots or land owned by the borrower. These loans are designed to help low-to-moderate income families achieve affordable housing.

Key Features:

-

Flexibility: Title I loans can be used for homes on rented lots, making them ideal for mobile home parks.

-

Lower Interest Rates: These loans typically offer lower interest rates compared to personal property loans.

-

Longer Repayment Terms: Borrowers can benefit from extended repayment terms, which help to keep monthly payments manageable.

-

Moderate Down Payment: While down payment requirements are generally lower than those of conventional loans, they are still required.

Eligibility Requirements:

-

Credit Score: FHA Title I loans have more lenient credit requirements, making them accessible to individuals with lower credit scores.

-

Income Verification: Borrowers must provide proof of steady income to demonstrate their ability to repay the loan.

-

Home Standards: The mobile home must meet certain standards set by the FHA, including being constructed after June 15, 1976, and built according to the Federal Manufactured Home Construction and Safety Standards.

Loan Limits:

-

Single-Section Homes: Up to $69,678 for a mobile home.

-

Multi-Section Homes: Up to $92,904 for a mobile home.

-

Home and Lot: Up to $23,226 for a lot where the home will be placed.

Repayment Terms:

-

Mobile Home Alone: Maximum term of 20 years.

-

Home and Lot: Maximum term of 25 years.

-

Lot Only: Maximum term of 15 years.

FHA Title II Loans:

FHA Title II loans, also known as real property mortgages, are designed for mobile homes that are permanently affixed to a foundation and classified as real estate. These loans provide benefits similar to traditional mortgages, making them suitable for borrowers who own the land on which their mobile home sits.

Key Features:

-

Real Property Classification: Treats the mobile home as real estate, which can lead to better loan terms and interest rates.

-

Lower Interest Rates: Offers competitive interest rates similar to traditional home mortgages.

-

Longer Repayment Terms: Typically provides repayment terms ranging from 15 to 30 years, allowing for more manageable monthly payments.

-

Refinancing Options: Borrowers can refinance existing mobile home loans under Title II, potentially lowering their interest rate and monthly payment.

Loan Limits:

-

Vary by Area: Loan limits for FHA Title II loans are determined by the FHA and can vary based on the location and property values in the area.

Repayment Terms:

-

Typically 15 to 30 Years: Longer terms are available, similar to traditional mortgages, providing more flexibility in repayment.

Benefits of FHA Title Loans

FHA Title loans for mobile homes offer several advantages that make them an attractive option for many buyers:

-

Accessibility: With more lenient credit requirements, these loans are accessible to a wider range of borrowers.

-

Affordability: Lower down payment requirements and competitive interest rates make these loans affordable.

-

Flexibility: The ability to finance homes on rented lots or owned land provides flexibility for various living arrangements.

-

Stability: Longer repayment terms ensure that monthly payments remain manageable, providing financial stability for borrowers.

VA Loans

VA loans are a valuable financing option offered by the Department of Veterans Affairs (VA) to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans are designed to help service members achieve homeownership, and they can be used to purchase or refinance mobile homes and the land they occupy. VA loans offer several benefits that make them an attractive choice for eligible borrowers.

VA loans can be used for:

-

Purchasing a new or existing mobile home

-

Purchasing the land on which the mobile home will be placed

-

Refinancing an existing mobile home loan

Conventional Loans

Conventional loans for mobile homes are available through private lenders and banks and can be used for both personal property and real estate transactions. These loans differ from government-backed loans, such as FHA or VA loans, in that they are not insured or guaranteed by a federal agency.

Because of this, conventional loans often have stricter qualification requirements, including higher credit scores and larger down payments. However, they can offer competitive terms for qualified borrowers.

Usage:

-

Personal Property: Financing for mobile homes that are not permanently affixed to land, often situated in mobile home parks or on leased land.

-

Real Estate: Financing for mobile homes that are permanently installed on owned land, treating the home as real estate.

USDA Loans

USDA loans, offered by the United States Department of Agriculture, provide an excellent financing option for purchasing mobile homes in designated rural areas. These loans are part of the USDA Rural Development program and are designed to promote homeownership in less populated regions. One of the most significant advantages of USDA loans is that they often require no down payment, making them an attractive choice for eligible buyers.

Usage:

-

Financing for mobile homes and the land on which they are placed.

-

Applicable only in designated rural areas as defined by the USDA.

Rent-to-Own Options

Rent-to-own options provide a flexible pathway to homeownership for individuals who may not immediately qualify for a traditional mortgage or who need time to save for a down payment.

These arrangements allow prospective buyers to lease a mobile home with the option to purchase it after a set period. This approach can be especially beneficial for those looking to improve their credit scores or accumulate savings while securing a future home.

Key Features:

-

Rent Payments: A portion of the monthly rent payments is often credited towards the eventual purchase price, building equity for the prospective buyer.

-

Option Fee: An upfront fee, known as an option fee or option consideration, is usually required. This fee provides the renter with the right to purchase the home in the future and is typically non-refundable.

-

Purchase Price: The purchase price is agreed upon at the beginning of the lease term, providing price certainty for the buyer, which can be advantageous if property values increase.

Factors Affecting Mobile Home Loan Eligibility

1. Credit Score Requirements

Credit scores play a significant role in determining eligibility for mobile home loans. Higher credit scores generally result in better loan terms and lower interest rates. Each type of loan has its own minimum credit score requirements, with government-backed loans often being more lenient than conventional loans.

2. Down Payment Considerations

The required down payment for a mobile home loan can vary depending on the type of loan and the lender. Government-backed loans like FHA and VA loans often have lower down payment requirements, while conventional loans may require a larger down payment. A higher down payment can also improve your chances of securing favorable loan terms.

3. Income and Employment Verification

Lenders typically require proof of stable income and employment when considering a mobile home loan application. This verification helps lenders assess your ability to repay the loan. Be prepared to provide recent pay stubs, tax returns, and employment history as part of the application process.

4. Mobile Home Location and Age

The location and age of the mobile home can impact loan eligibility and terms. Newer homes and those situated on owned land generally qualify for more favorable loan terms. Homes in mobile home parks or on leased land may still be eligible for loans but might come with higher interest rates and shorter terms.

Learn more- Unlocking the Secret: How Long Do Mobile Homes Last?

5. Loan Amount and Repayment Capacity

Lenders will assess your ability to repay the loan based on the amount you are borrowing and your overall financial situation. This assessment includes evaluating your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income. A lower debt-to-income ratio improves your chances of loan approval and better terms.

How Long Are Mobile Home Loans?

The length of mobile home loans varies based on the type of loan and the lender. Common loan terms range from 15 to 30 years, with shorter terms typically associated with personal property loans and longer terms available for real property mortgages. The term of the loan will affect your monthly payments and the total interest paid over the life of the loan.

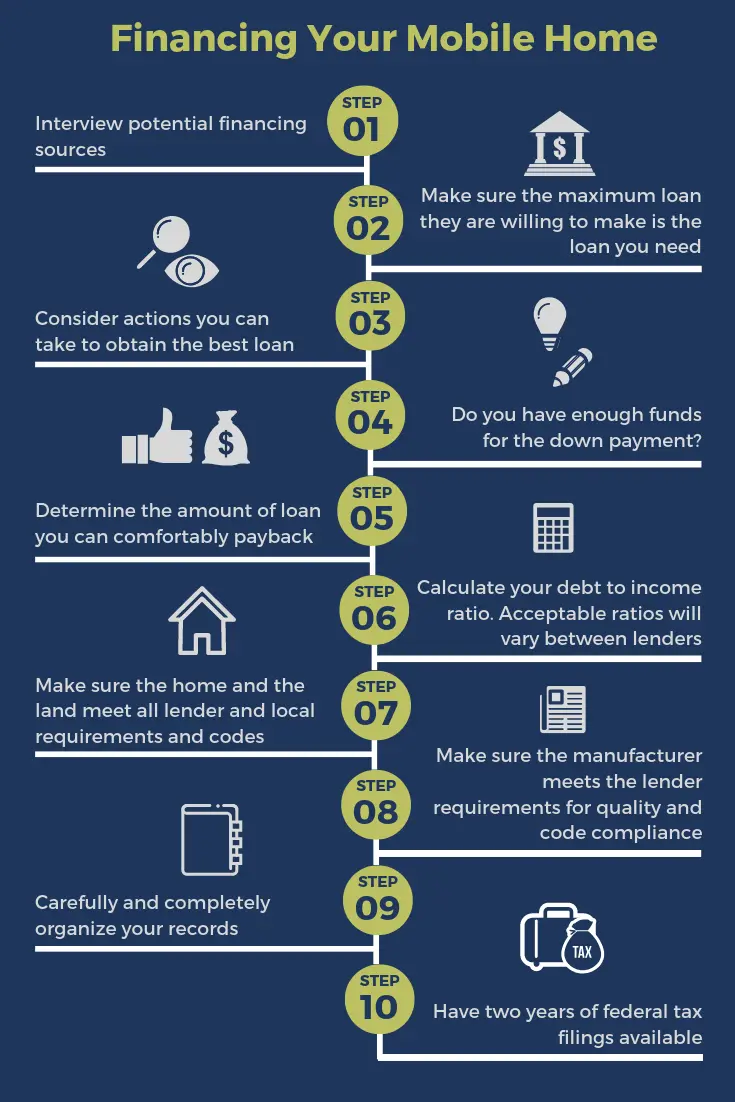

How to Apply for a Mobile Home Loan

Applying for a mobile home loan involves several steps:

-

Determine Your Budget: Assess your financial situation to determine how much you can afford to spend on a mobile home and the associated loan payments.

-

Check Your Credit: Obtain your credit report and score to understand your creditworthiness. Address any issues or errors on your report before applying for a loan.

-

Research Lenders: Compare loan options from various lenders, including banks, credit unions, and online lenders. Consider interest rates, terms, and eligibility requirements.

-

Gather Documentation: Prepare the necessary documentation, such as proof of income, tax returns, and identification, to submit with your loan application.

-

Submit Applications: Apply for pre-approval from multiple lenders to compare offers and terms. Pre-approval can also give you a better idea of your budget and purchasing power.

-

Choose a Loan: Review the loan offers and choose the one that best fits your needs and financial situation.

-

Close the Loan: Complete the loan closing process, which involves signing the final paperwork and paying any closing costs. Once the loan is closed, you can proceed with purchasing your mobile home.

Conclusion: Wrapping It Up

Securing a mobile home loan is a crucial step in purchasing a mobile home. By understanding the different types of loans, eligibility factors, and application processes, you can make an informed decision that best suits your needs. Whether you choose a government-backed loan, a conventional loan, or a rent-to-own option, careful planning and research will help you navigate the process and achieve your goal of owning a mobile home.